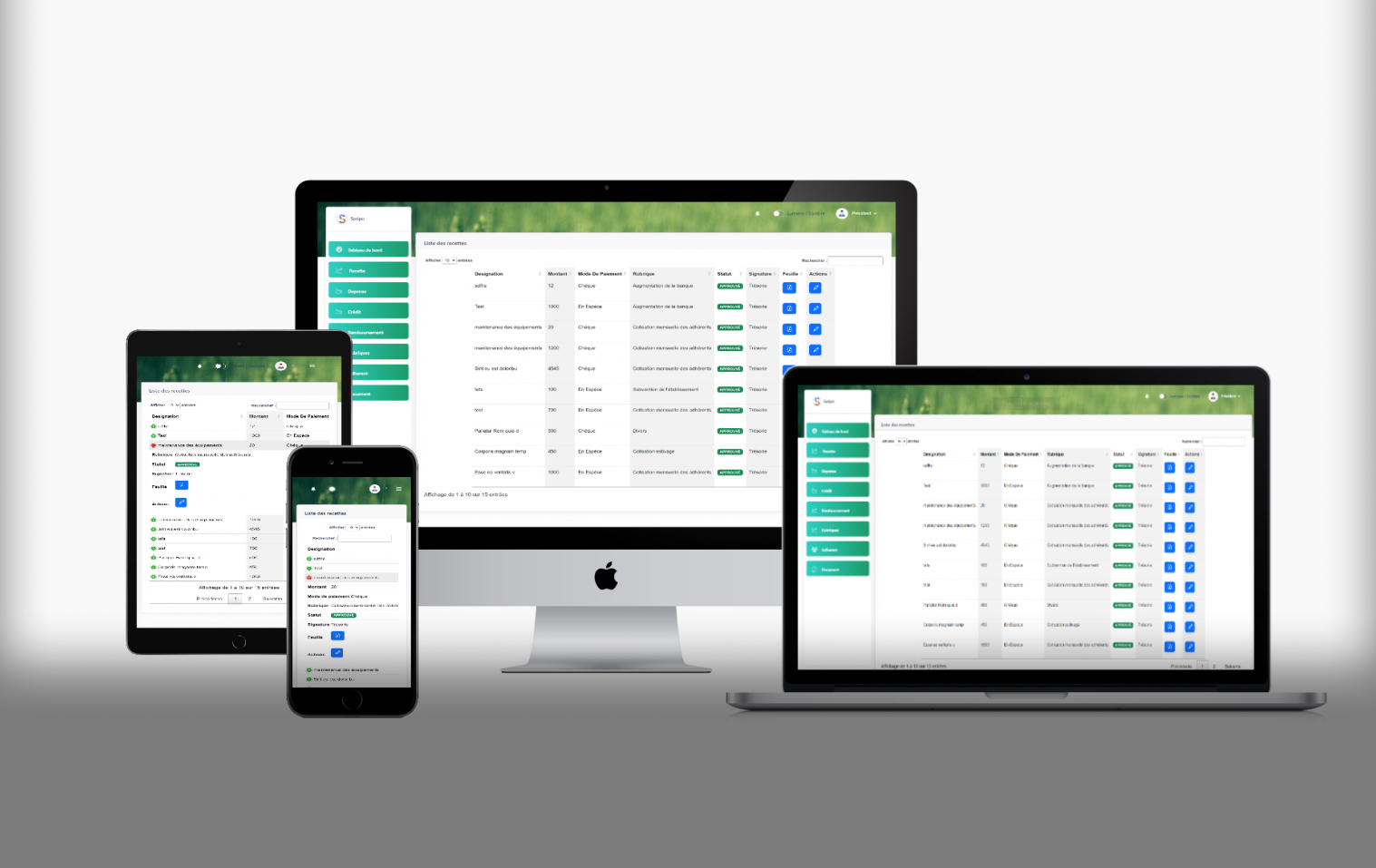

SOSIPO Financial Management App

SOSIPO Financial Management App

Overview

Welcome to the SOSIPO Financial Management App, a robust web application developed for the SOSIPO Association by Hoceine El Idrissi. This project aims to automate processes, enhance transparency, and achieve financial stability and member satisfaction.

Mission and Challenges

Our mission was clear: ensure financial stability, sustainable growth, and provide vital support to SOSIPO Association members. Challenges included manual processes hindering communication, complex approval workflows causing inefficiencies, and ineffective resource management impacting member satisfaction.

Goals and Objectives

- Enhance Resource Management and Member Satisfaction:

- Streamlined processes for efficient resource allocation.

- Elevated member satisfaction through transparent and responsive financial assistance.

- Drive Operational Efficiency:

- Automated request management and approval workflows for faster decision-making.

- Implemented innovative solutions to eliminate bottlenecks.

- Implement Transparency:

- Provided simple statistics and charts for accounting processes, ensuring transparency.

- Enhanced communication channels to keep members informed.

Innovative Solutions

To achieve these objectives, we introduced innovative solutions:

- Efficient Request Tracking System:

- Robust system for the efficient submission and approval of financial requests.

- Automated workflows to expedite processes and reduce manual efforts.

- Automated Document Management:

- Implemented an automated system for document storage, retrieval, and sharing.

- Eliminated manual paperwork, reducing errors and enhancing overall efficiency.

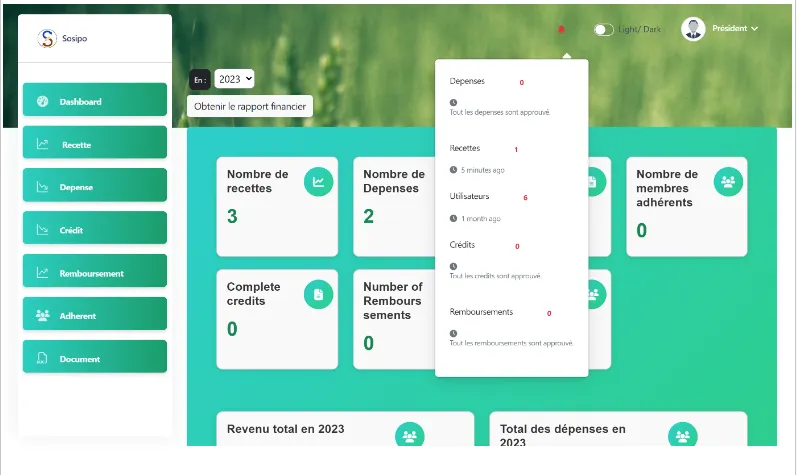

- Data-Driven Decision-Making:

- Provided SOSIPO with simple statistics and charts for accounting processes.

- Enabled better decision-making to increase overall efficiency and productivity.

- Multi-Profile Access:

- Designed the system to accommodate three user profiles: President, Treasurer, and Secretary General.

- Each profile has specific roles and access levels, ensuring secure and controlled access.

Technologies Used

- Laravel: Leveraged for robust web development.

- MySQL: Ensured secure and efficient database management.

- Bootstrap: Utilized for a responsive and visually appealing design.

- JavaScript: Employed for dynamic and interactive features.

- ChartJs: Integrated for visually representing financial data.

- Ajax: Implemented for seamless and asynchronous data retrieval.

Potential Benefits and Impact

Benefits

- Cost Reduction:

- Streamlining administrative and accounting tasks reduces manual paperwork and minimizes human errors, leading to substantial cost savings.

- Automation of processes saves time and effort, allowing resources to be allocated more efficiently.

- Efficiency Improvements:

- Faster and more accurate data management enables real-time tracking of member requests, document management, and financial transactions.

- Improved productivity and responsiveness lead to better service delivery, enhancing overall member satisfaction.

- Enhanced Data Management:

- Proper organization, storage, and retrieval of administrative documents and financial records ensure data integrity and security.

- Centralized access to data facilitates efficient data management and ensures compliance with privacy regulations.

- Availability of comprehensive reports and analytics enables informed decision-making and strategic planning.

Potential Positive Outcomes

- Improved Member Experiences and Satisfaction:

- Streamlined request processing, faster response times, and efficient communication channels enhance overall service quality.

- Members experience a more seamless and user-friendly interaction with the association.

- Increased Operational Transparency:

- Centralized document management ensures transparency in administrative processes.

- Members and authorized users can access documents and reports, promoting openness and accountability.

Feedback Real Case Scenarios

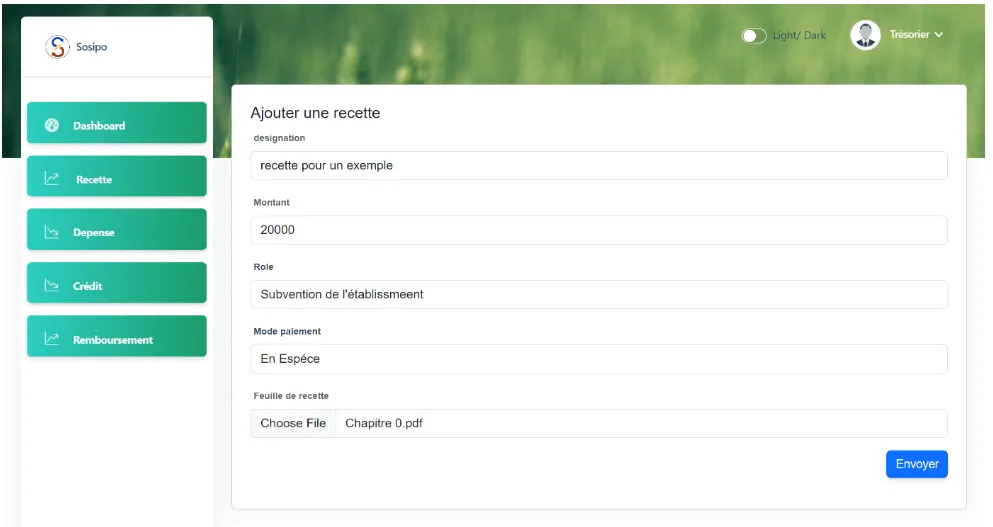

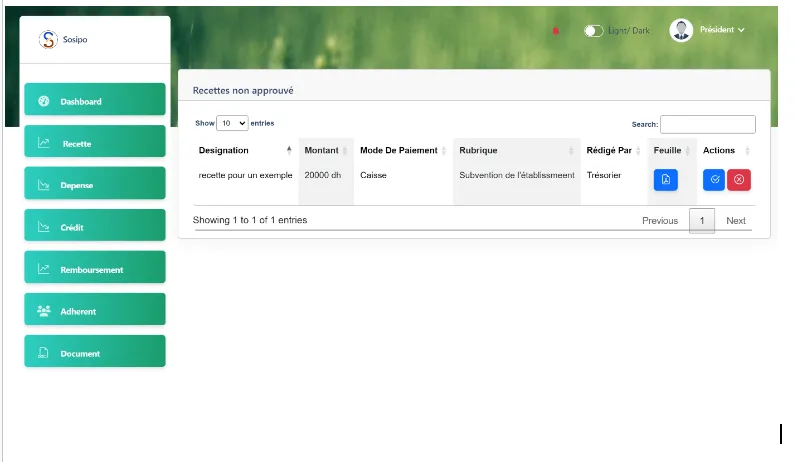

Scenario 1: Income Approval Process

- Treasurer Login:

- The Treasurer logs into the application using their credentials.

- Adding Income Entry:

- Navigates to the financial management section and adds a new recette (income) entry, providing details such as the amount, date, and purpose.

- Navigates to the financial management section and adds a new recette (income) entry, providing details such as the amount, date, and purpose.

- Submission for Approval:

- Submits the recette entry for approval.

- Submits the recette entry for approval.

- President's Approval:

- The President logs into the application using their credentials.

- Navigates to the approval section and sees the pending recette entry from the Treasurer.

- Review and Decision:

- Reviews the details of the recette entry and either approves or rejects it, providing comments if necessary.

- Reviews the details of the recette entry and either approves or rejects it, providing comments if necessary.

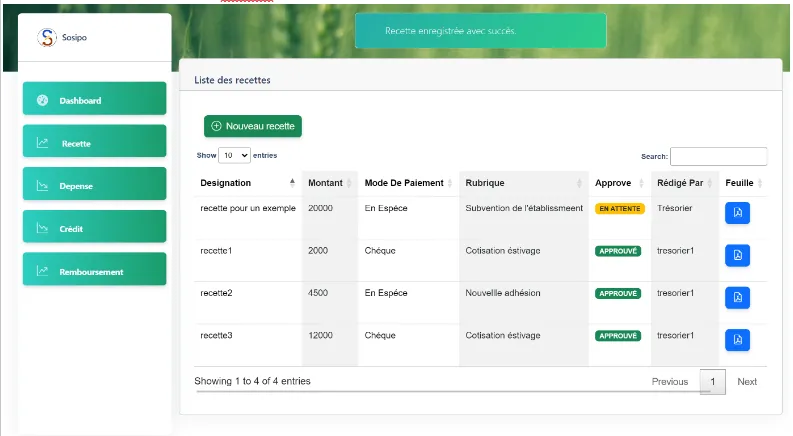

- Status Check:

- The Treasurer logs back into the application and checks the status of the recette entry.

- Outcome Review:

- Sees the updated status of the recette entry based on the President's approval decision.

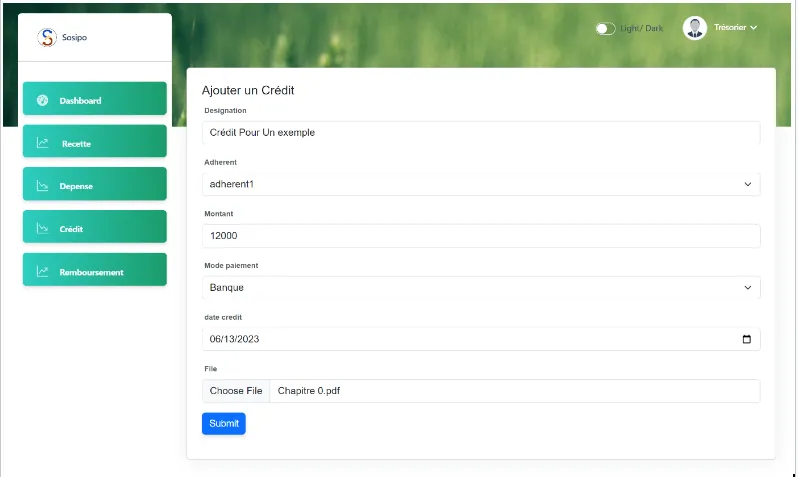

Scenario 2: Credit and Remboursement Approval Process

- Treasurer Login:

- The Treasurer logs into the application using their credentials.

- Adding Credit Entry:

- Navigates to the financial management section and adds a new credit entry, specifying the amount, date, and purpose.

- Navigates to the financial management section and adds a new credit entry, specifying the amount, date, and purpose.

- Submission for Approval:

- Submits the credit entry for approval.

- President's Approval:

- The President logs into the application using their credentials.

- Navigates to the approval section and finds the pending credit entry from the Treasurer.

- Review and Decision:

- Reviews the details of the credit entry and either approves or rejects it, providing comments if necessary.

- Credit Approved:

- If the credit entry is approved, the Treasurer logs back into the application and checks the status of the credit entry.

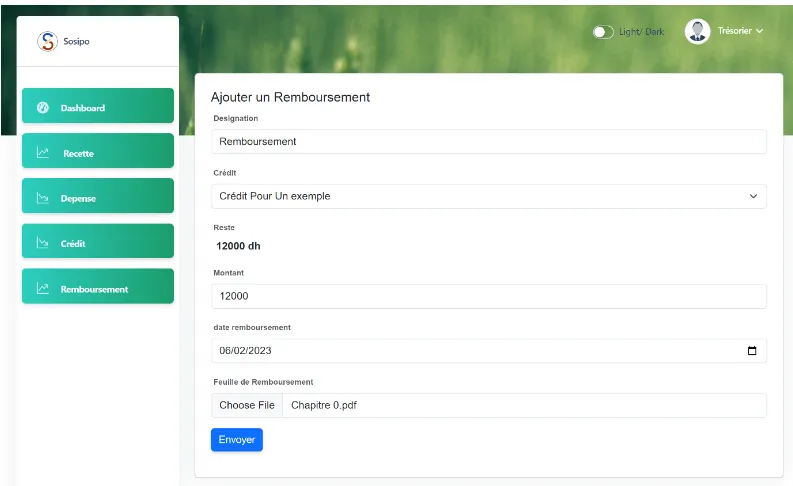

- Adding Repayment Entry:

- The Treasurer proceeds to add a remboursement (repayment) entry, indicating the amount and selecting the relevant credit entry. The system automatically calculates and displays the remaining amount of the credit.

- The Treasurer proceeds to add a remboursement (repayment) entry, indicating the amount and selecting the relevant credit entry. The system automatically calculates and displays the remaining amount of the credit.

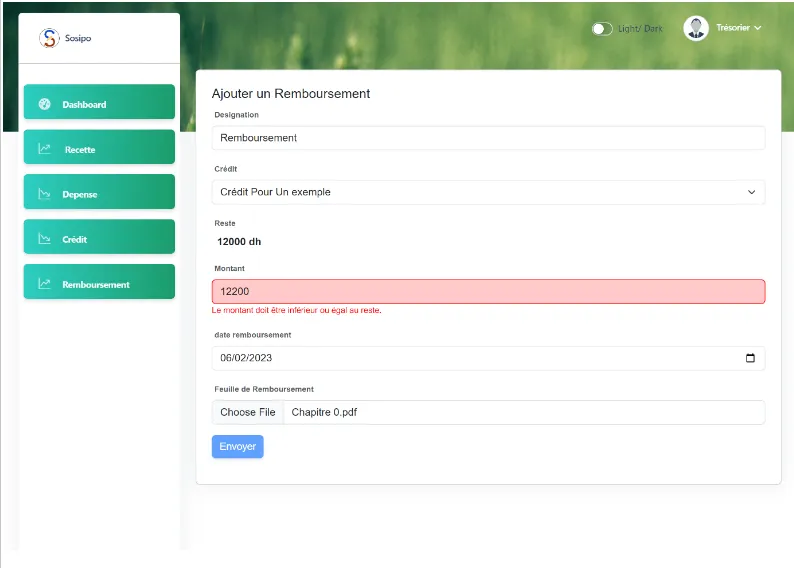

- Validation Check:

- If the amount of the repayment inserted is more than the credit's, it will show a red highlight in the amount field.

- If the amount of the repayment inserted is more than the credit's, it will show a red highlight in the amount field.

- Remboursement Submission:

- The Treasurer submits the remboursement entry for approval.

- President's Approval:

- The President reviews the remboursement entry and approves or rejects it based on the provided information.

- Viewing Status:

- The Treasurer can view the status of the remboursement entry, including the updated remaining amount of the credit.

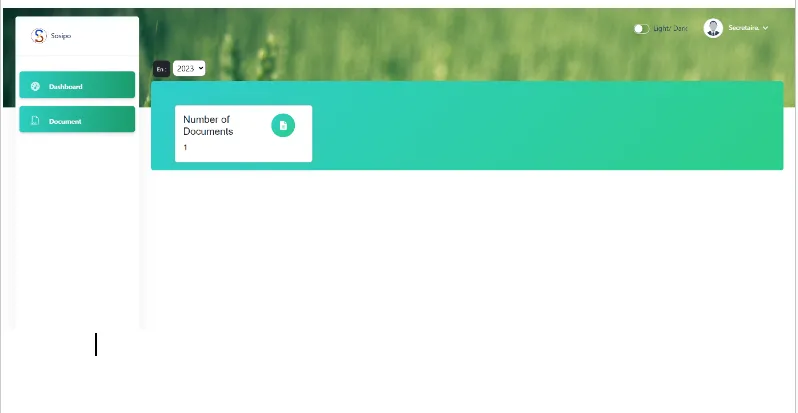

Scenario 3: Document Upload and Review

- Secretary Login:

- The Secretary logs into the application using their credentials.

- The Secretary logs into the application using their credentials.

- Adding Document:

- Navigates to the document management section and selects the option to add a new document.

- Document Upload:

- Uploads a document, provides a title, and selects the appropriate category or tags for easy retrieval.

- Automatic Storage:

- The document is automatically saved and stored in the system's database.

- Search and Access:

- The Secrétaire or other authorized users can search for and access the uploaded document at any time.

- President's Review:

- The President and other authorized users can also view the uploaded document, ensuring transparency and accessibility.

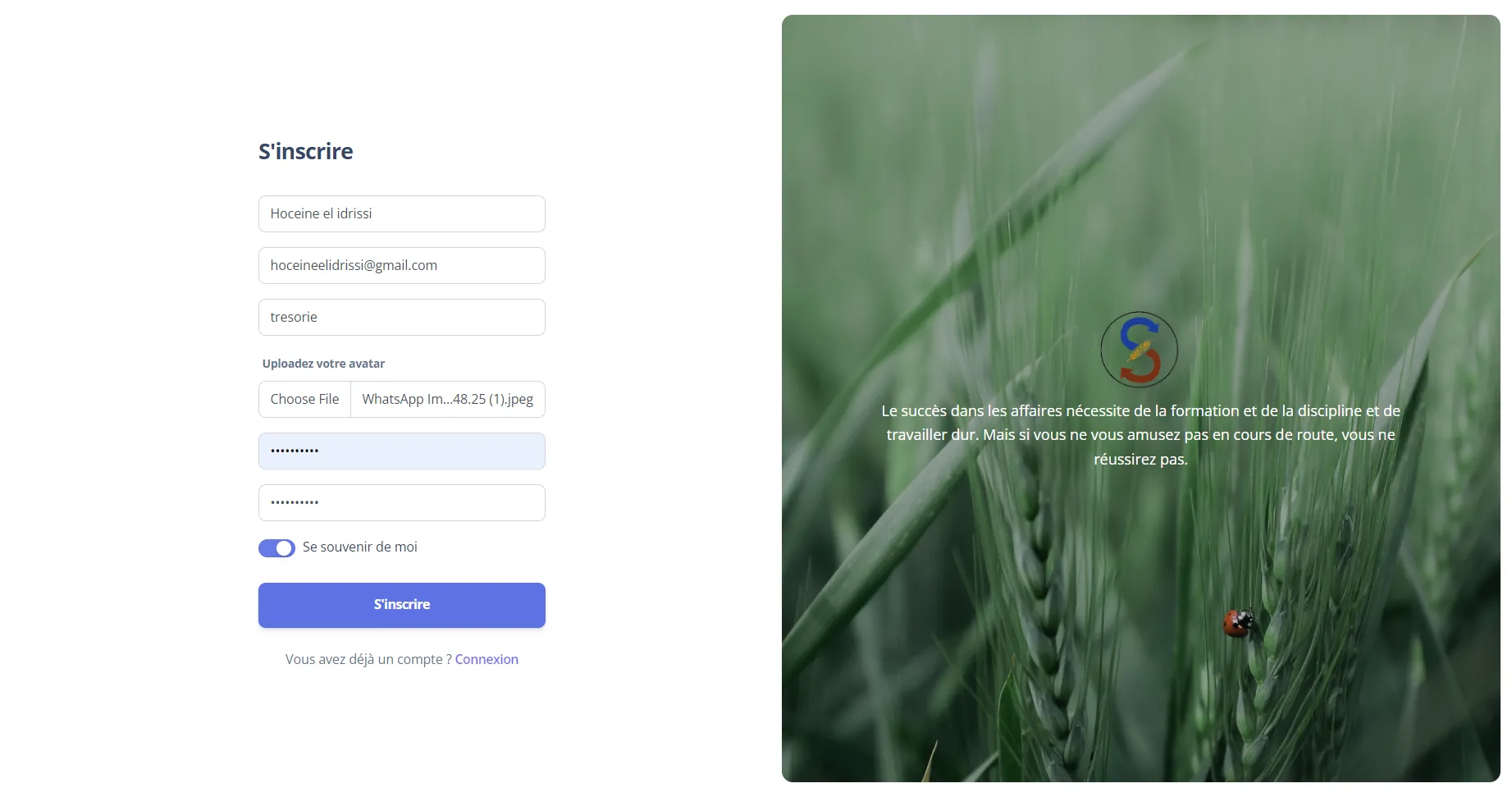

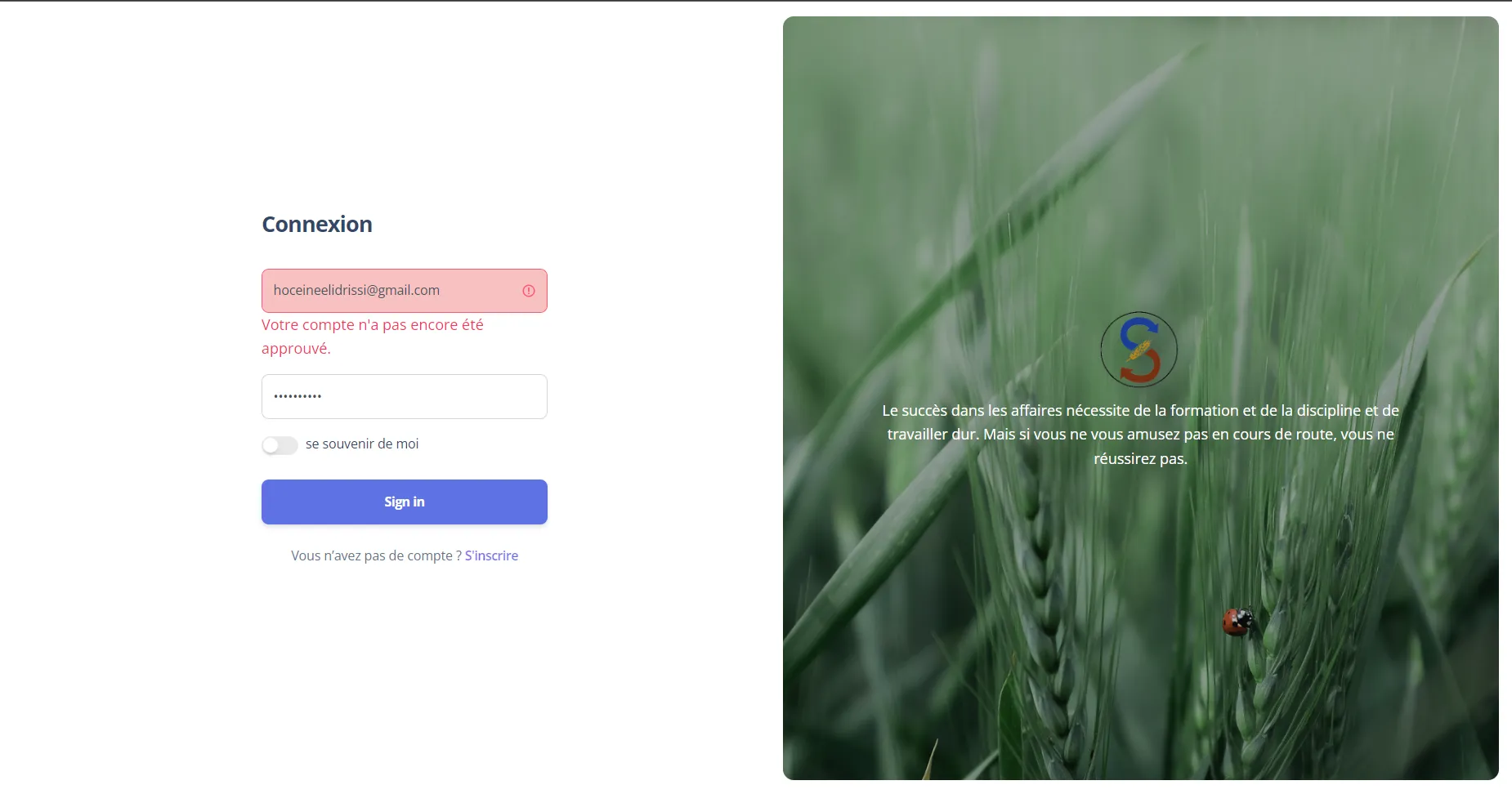

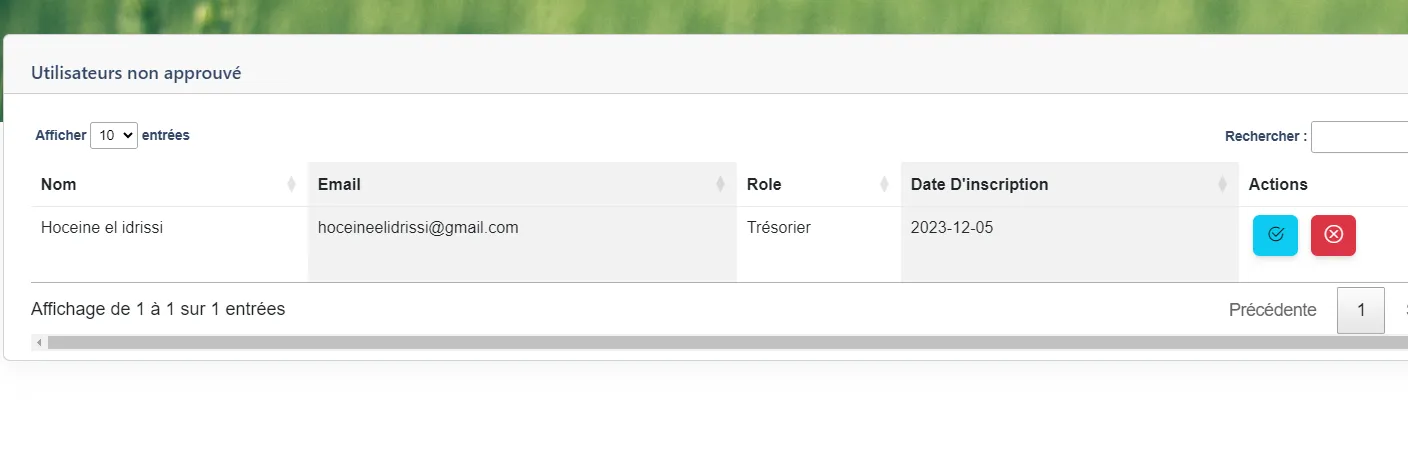

Scenario 4: New Treasurer/Secretary Registration and Approval

- New Treasurer/Secretary Registration:

- A new Treasurer or Secretary registers in the application.

- A new Treasurer or Secretary registers in the application.

- Awaiting Approval:

- The new user can't use the app until the President accepts and approves their registration.

- The new user can't use the app until the President accepts and approves their registration.

- President's Action:

- The President logs into the application, reviews the new registration, and either approves or rejects it.

- The President logs into the application, reviews the new registration, and either approves or rejects it.

- Access Granted:

- If approved, the new Treasurer or Secretary gains access to the application and can start using its features.

Learn More

Join us in exploring this comprehensive project, setting benchmarks for excellence in web development while ensuring financial stability and member satisfaction for SOSIPO Association.